Mocking the growth of wine and spirits at the expense of beer has been an easy refrain, but the reality is other areas of the alcohol industry are seeing just as much—if not more—success. Despite the number of retail stores declining, the number of wine-selling locations has expanded by 120,000 in the past 10 years. The number of wineries is creeping toward 10,000. In 2017 alone, the number of active craft distilleries grew by almost 21% to about 1,600. Dollar sales for these small businesses grew by 25%. And don’t look now, but the plethora of options has been impacting overall choice, most notably from alcohols’ youngest consumers.

A host of data in part one of this series shows that even though the threat of Anheuser-Busch InBev, MillerCoors, or Constellation Brands may seem like what craft aficionados need to worry about most when it comes to evangelizing beer, a big problem facing the beer industry isn’t from multinational companies snapping up small breweries. It’s the finite number of drinkers and servings that exist each year, and finding ways to make sure beer is a part of that.

Source: The Washington Post

This is why more conversations are taking place about the need to expand beer’s consumer base, especially when it comes to attracting non-white, non-male drinkers. For craft beer, sales can’t only rely on storytelling about emotions and independence for the economics to work in the industry’s favor. Outreach needs to occur.

Comparing overall dollar sales of beer, wine, and spirits can be tricky, as there’s typically a lapse in annual data, let alone what is publicly available. However, beer’s long standing use of dollar sales to showcase its top spot isn’t as strong as it seems.

News reports for both 2015 and 2016 cite beer’s sales figures in the U.S. at 206.7 million barrels worth a total of $107.6 billion. In 2016, spirits accounted for $78 billion of sales and wine accumulated about $60 billion. But in terms of production levels, spirit volume was more than 12 times less than beer (16.9 million BBLs) and wine was almost seven times less (30.7 million BBLs).

The trendline isn’t looking good. According to Forbes, beer’s overall share of the alcoholic beverage market decreased from 56% to 46% in roughly the past 20 years, with 2% of that volume going to wine and 8% to spirits. Kraig Naasz, president of the Distilled Spirits Council, told Forbes that “adult consumers, particularly millennials…enjoy exploring different spirits categories, learning about how and where they are produced, and sharing their spirits knowledge and experiences with their friends."

Even craft spirit growth is outpacing craft beer these days. It’s quite the bind for the beer industry. Because the general percentage of drinkers in the U.S. is steady, the ever-growing presence of wine and spirits is impacting its proverbial piece of the pie. Worst of all: that pie ain’t getting any bigger.

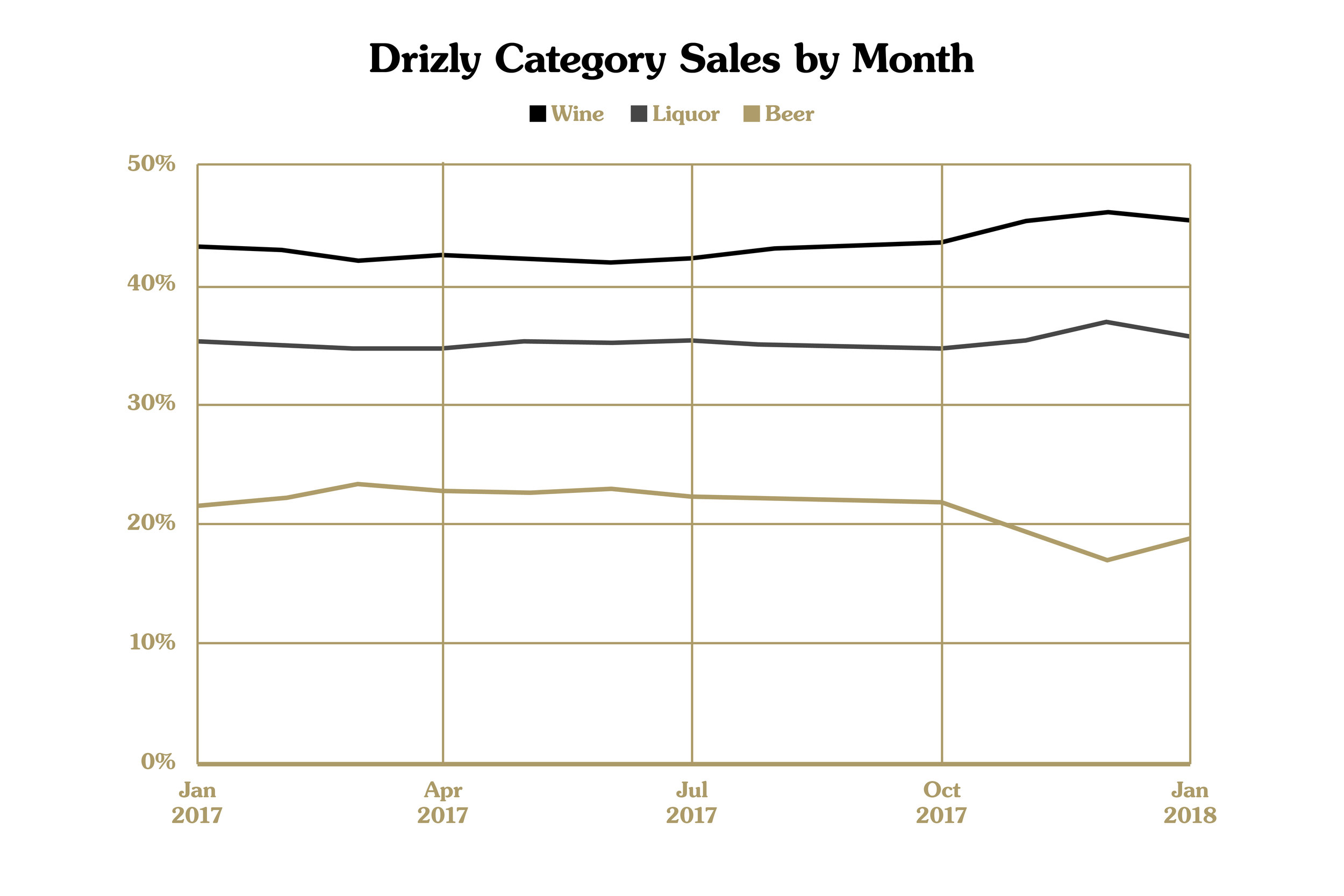

While what’s being drank is important to future business holdings in beer, it also matters where drinking takes place. Both on- and off-premise, spirits and wine are gaining more than beer. Even alcohol delivery service Drizly has seen a shift in overall beer trends.

In February, wine (45.1%) and liquor (35.3%) accounted for more than three-quarters of online orders. They also typically outsell beer, though that could be because of the ease of which beer can be purchased in a variety of off-premise accounts. In January 2018, beer lost about 3% of sales through Drizly compared to January 2017, with most of that loss coming from domestic brands.

Source: Drizly

“‘Drinking at home’s growth is outpacing ‘drinking out of home,’” Danny Brager, senior vice president of Nielsen’s Beverage Alcohol practice recently said in a breakdown of alcohol options and popularity. “While both channels are critical, the off-premise continues to be not only significantly larger volumetrically than on-premise, but also the environment currently offering the larger growth opportunities.”

This matters in particular because, as Brager noted, there is “an increasing expectation that on-premise operators must deliver experiences that are truly worth leaving the house for.”

So, what’s been the antidote in recent years? The rise of the brewery taproom is the ultimate trump card for today’s breweries looking to deliver authentic and unique experiences—not to mention the freshest beer possible and, typically, some specials or one-offs, too. For Brewers Association-defined craft breweries, about 10% of their production volume is sold on-site.

Nick Hines, who covers bars, cocktails, and spirits for Supercall, says there’s still room for all three. He notes beer’s biggest growth problem might be with national craft breweries, pointing to Green Flash’s recent foreclosure. On the whole, people aren’t going to stop drinking beer, he says, but varying preferences could lead to more integrated businesses like Threes Brewing in Brooklyn, which sells spirits and cocktails alongside craft beer. That should be the norm, he adds.

“A leveling off was bound to happen,” Hines tells GBH. “Plus, life is more fun when everyone—beer people, wine people, cocktail people, and spirits people—is invited to the party.”

When brewers and drinkers talk about battling each other, there’s another side to this story. While it’s true craft breweries have converted macro drinkers to more flavorful options from opposing adjunct lager, ABI isn’t simply trying to crush its competition as retaliation. It’s trying to spread into successful areas of a limited space. Brewers Association-defined craft may only make up about 13% of the American beer market, but its growth continues to push out longtime Light Lager brands, forcing parent companies like ABI to look elsewhere. It’s a natural shift when there’s only so much space—in beer aisles, in bars, and in our consumption.

“As we fight for consumer occasions and for consumer share of mind and for the loyalty from consumers," Andy Thomas, Craft Brew Alliance’s CEO, said in summer 2016, “we should be focused on [wine and spirits] instead of the zero-sum game of what we are focused on right now—tearing each other down."

—Bryan Roth

Three’s Company, or a Crowd? Pt. 1 — Beer’s Ongoing Battle with Wine and Spirits

Three’s Company, or a Crowd? Pt. 2 — Can Beer Reclaim Its Share?